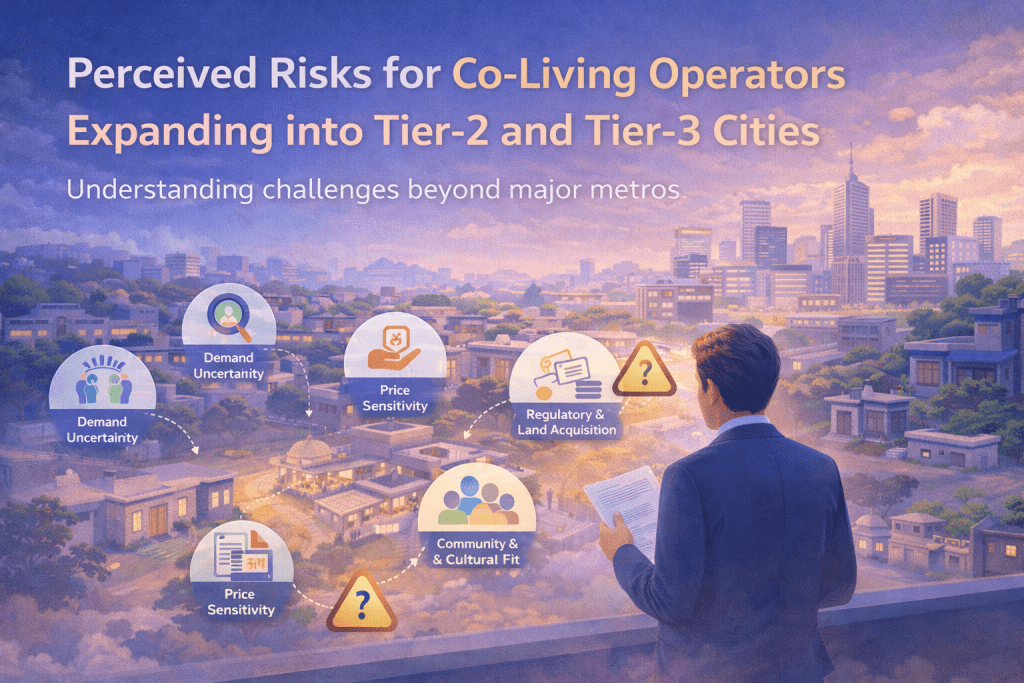

As co-living gains traction across India’s major urban corridors, many operators are eyeing Tier-2 and Tier-3 cities for the next phase of growth. While these markets offer massive opportunity, they also come with a set of perceived risks that many operators consider before expanding.

1. Demand Uncertainty and Market Education

In metros, young working professionals and students are familiar with organised co-living. In smaller cities, awareness is limited. Operators often perceive a risk of lower demand or longer sales cycles as potential residents may still prefer independent rentals or family stays. This means additional investment in market education and branding before occupancy stabilises.

2. Price Sensitivity and Yield Pressure

Tier-2/3 markets are more price-sensitive. Average rental affordability tends to be lower, and expectations on price vs amenities are sharper. Co-living operators worry about achieving viable pricing without eroding margins, particularly when local competition includes informal PGs or independent rentals with lower operating costs.

3. Operational Challenges and Talent

Running co-living at scale requires discipline in housekeeping, maintenance, community management, and tech-driven processes. In smaller cities, sourcing trained operations staff and building reliable third-party vendor networks is perceived as challenging, increasing the risk of inconsistent service delivery.

4. Regulatory and Land Acquisition Risks

Smaller municipalities may have less predictable zoning norms, licensing requirements, and landlord expectations. Negotiating leases and securing compliant assets can take longer, adding to rollout risk.

5. Community and Cultural Fit

Last but not least, co-living thrives on shared experiences and community living. Understanding local culture and preferences — which vary widely outside metros — is critical. Misalignment here can result in lower resident satisfaction and weaker retention.

At HooLiv, we’ve learned that Tier-2 and Tier-3 expansion isn’t about copying a metro playbook — it’s about rebuilding the model ground-up for local demand, pricing, and culture. By combining disciplined operations, tech-led controls, and deep on-ground understanding, we believe organised co-living can thrive beyond metros. The next wave of India’s housing demand will not come from the biggest cities — it will come from the fastest-growing ones, and HooLiv is committed to building for them, responsibly and sustainably.

Related Articles

The Blind Spot in Tier-2/3 Student Housing

Myths vs Facts: The Real Risks of Operating Co-Living in Tier-2 & Tier-3 Cities in India

Key Challenges Co-Living Operators Face in Tier-2 and Tier-3 Cities