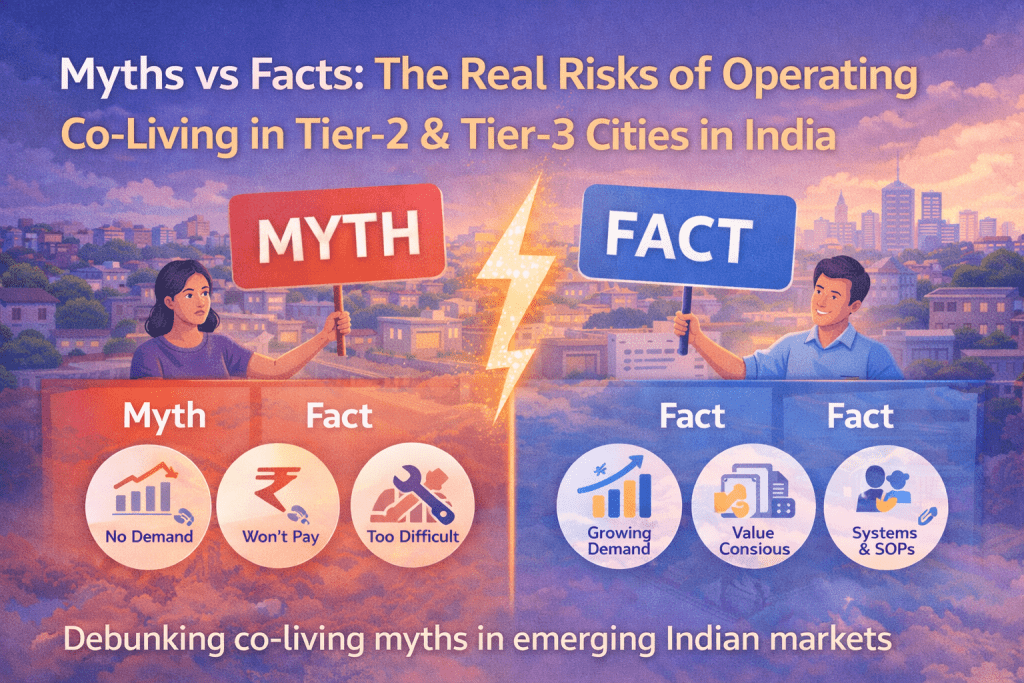

Expanding organised co-living into Tier-2 and Tier-3 cities in India is often viewed as risky. Many operators hesitate, holding onto assumptions about demand, pricing, and operations. Today, it’s time to separate myth from fact using real Indian market dynamics — because the future of co-living will be defined by these emerging urban centres.

Myth 1: There is no demand for co-living in Tier-2 & Tier-3 cities

Fact: Demand is already visible. According to industry reports, India’s organised co-living bed supply is expected to grow 3x by 2030, driven largely by non-metro cities. Tier-2 cities now host IT parks, skill hubs, medical colleges, MSMEs, and universities, all creating sustained rental demand. The need is not luxury — it’s clean, predictable, well-managed housing.

Myth 2: People won’t pay for organised co-living

Fact: Residents are price-conscious, not value-blind. They are willing to pay for safety, cleanliness, power backup, Wi-Fi, and transparent pricing. What fails is copying a metro-premium model into a price-sensitive market. Right-sized amenities outperform over-designed assets.

Myth 3: Operations are difficult without metro talent

Fact: Technology has flattened this risk. CRM-led check-ins, digital payments, smart locks, inventory tracking, and SOP-driven housekeeping reduce dependency on individuals. In fact, Tier-2 cities often show lower staff attrition and stronger local loyalty once systems are in place.

Myth 4: Regulatory and landlord risk is higher

Fact: Regulations are often simpler but less standardised. Operators who invest in local relationships and compliance clarity face fewer long-term issues than in over-regulated metros.

The HooLiv Lens

At HooLiv, we’ve learned that Tier-2 and Tier-3 cities don’t need a metro playbook — they need a local one. When pricing, operations, and expectations are aligned to the market, these cities deliver stronger unit economics and sustainable scale.

The future of Indian co-living will not be built only in metros — it will be built where India is actually growing.

Related Articles

The Blind Spot in Tier-2/3 Student Housing

Perceived Risks for Co-Living Operators Expanding into Tier-2 and Tier-3 Cities

Key Challenges Co-Living Operators Face in Tier-2 and Tier-3 Cities